SEBI Registered & Regulated

Fund Parking Platform

Tailored for businesses

Powered by fixed-income mutual funds which invest in high quality government and corporate short-term bonds

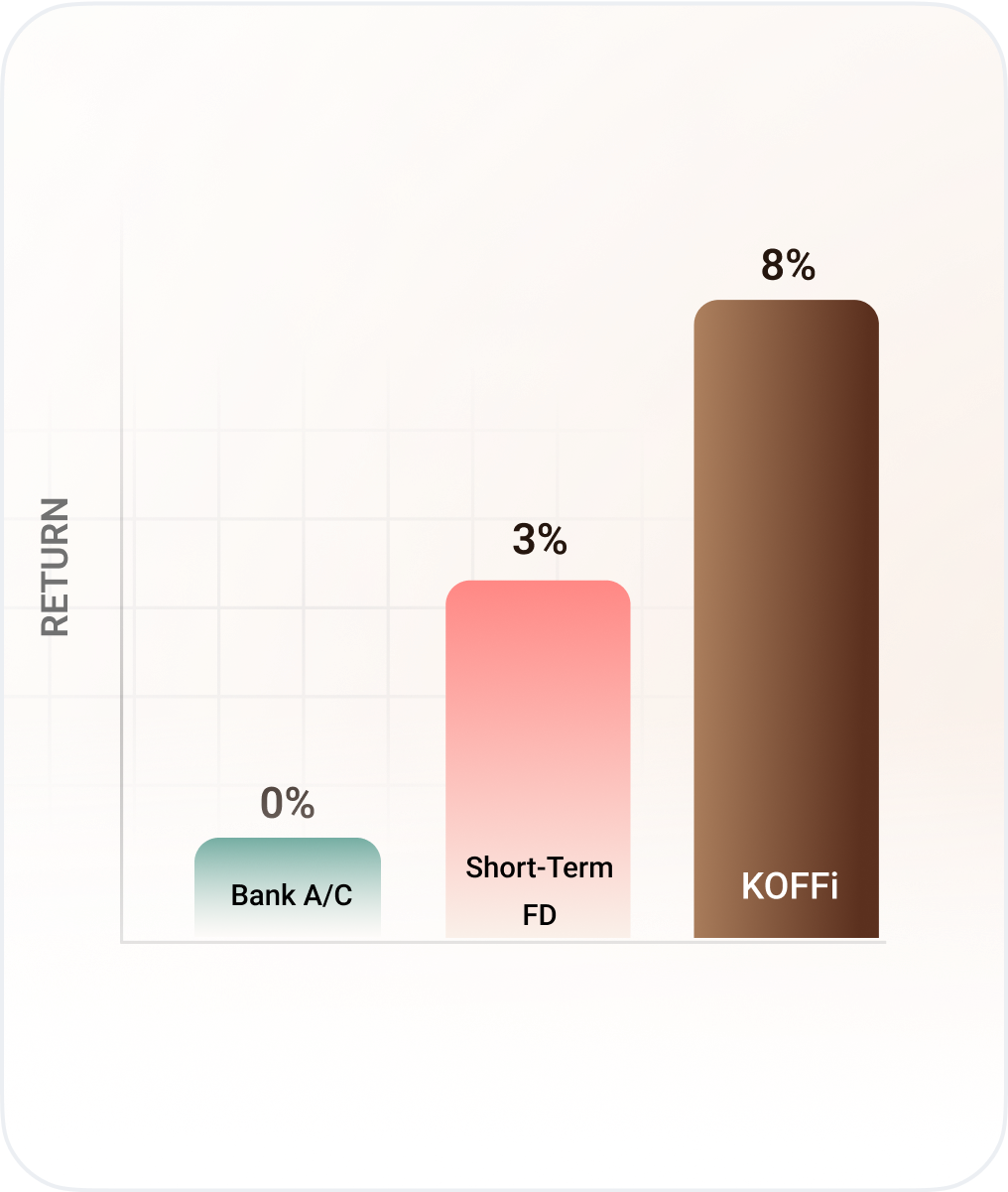

Higher Returns

Better Liquidity

Low Risk

Park Funds, Smartly!

Where your business funds grow, even between payouts

Safety, Priority

SEBI rated safest funds

High Yield

Better yield for short term

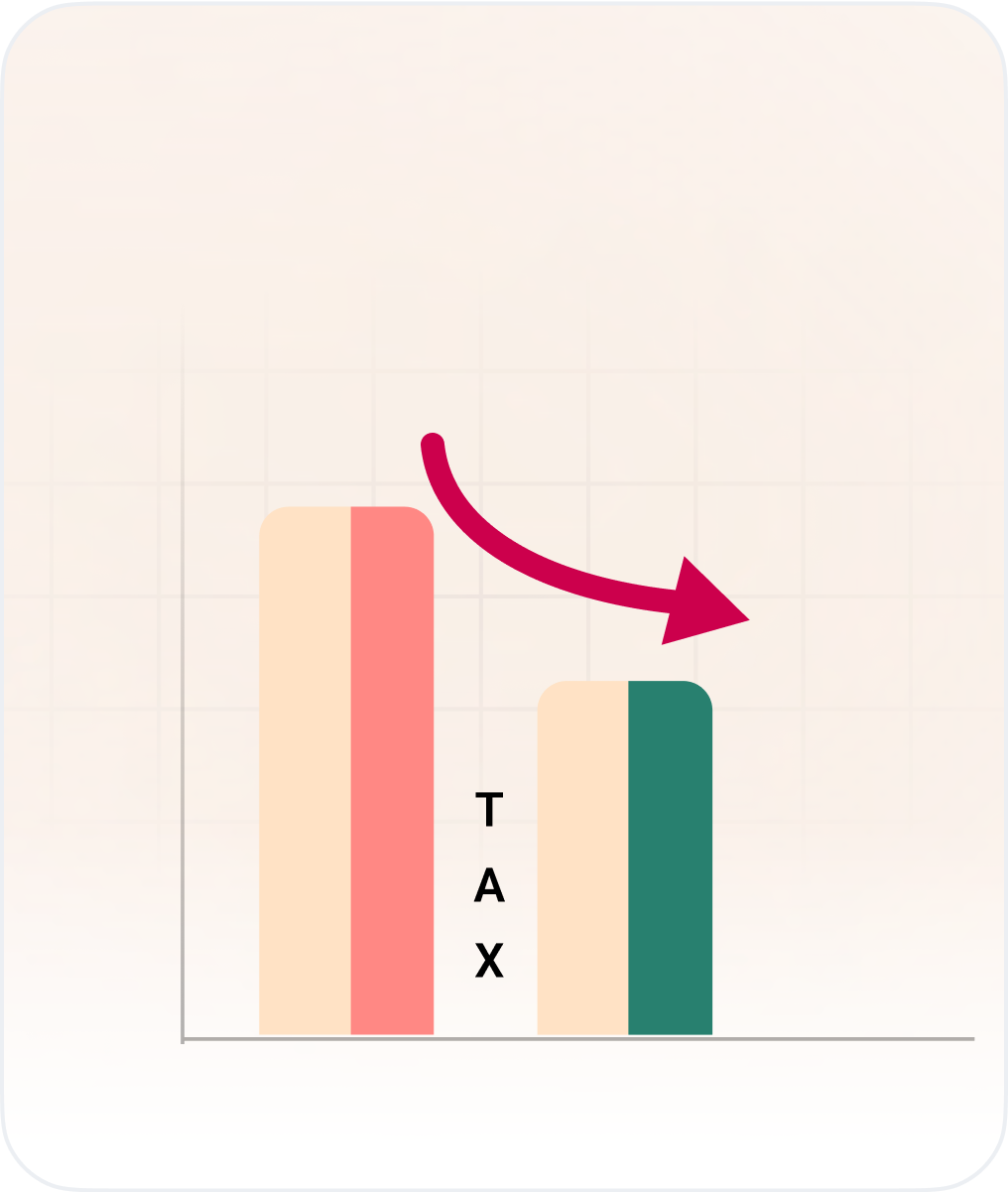

Lower Taxation

Tax friendly fund selection

Park Directly

Money is held with trusted partners.

How it Works

Link Bank Account

Use your existing bank account

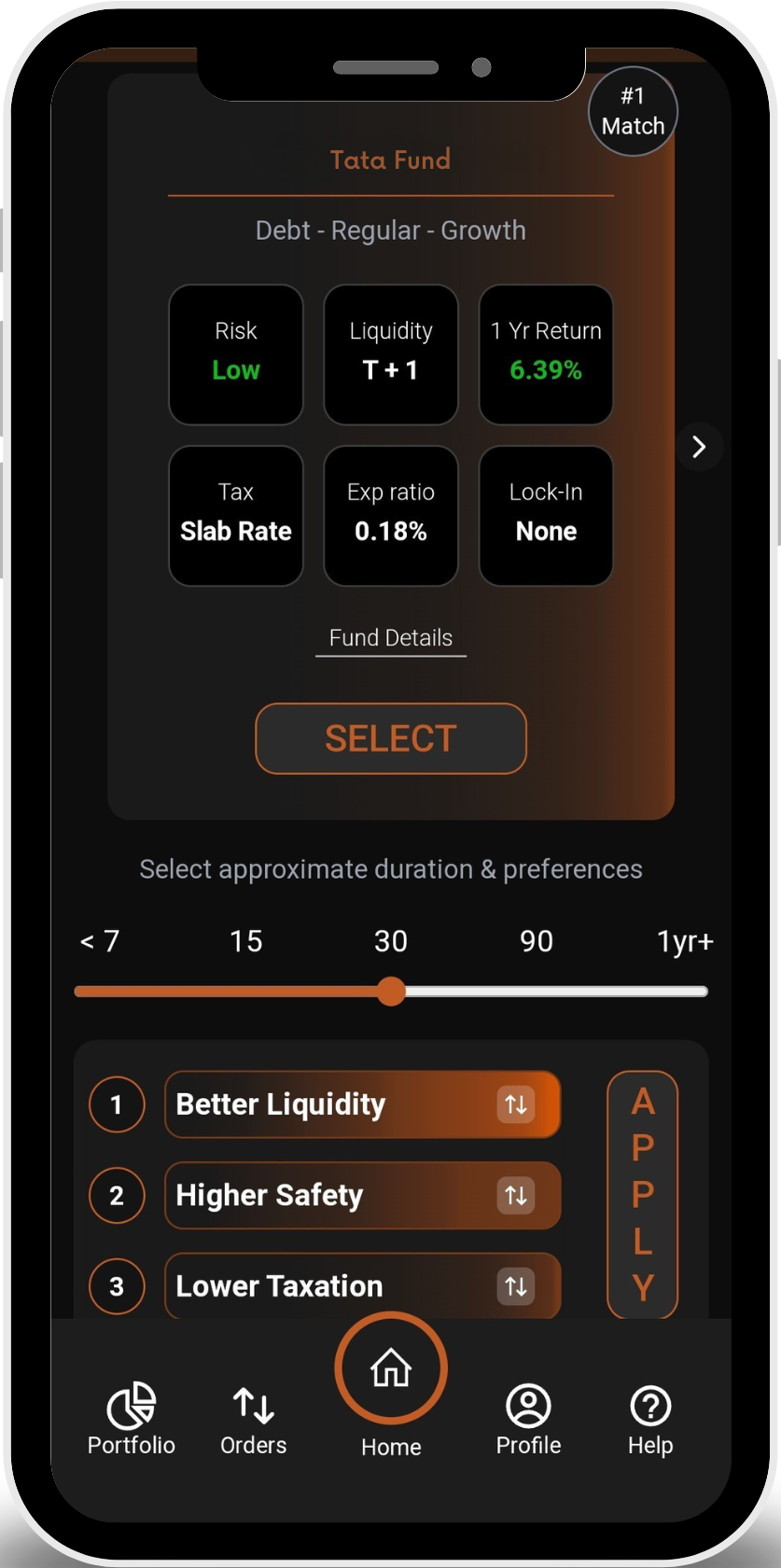

Select Fund

Tailored for your business need

Park Directly

Into select fixed-income mutual funds

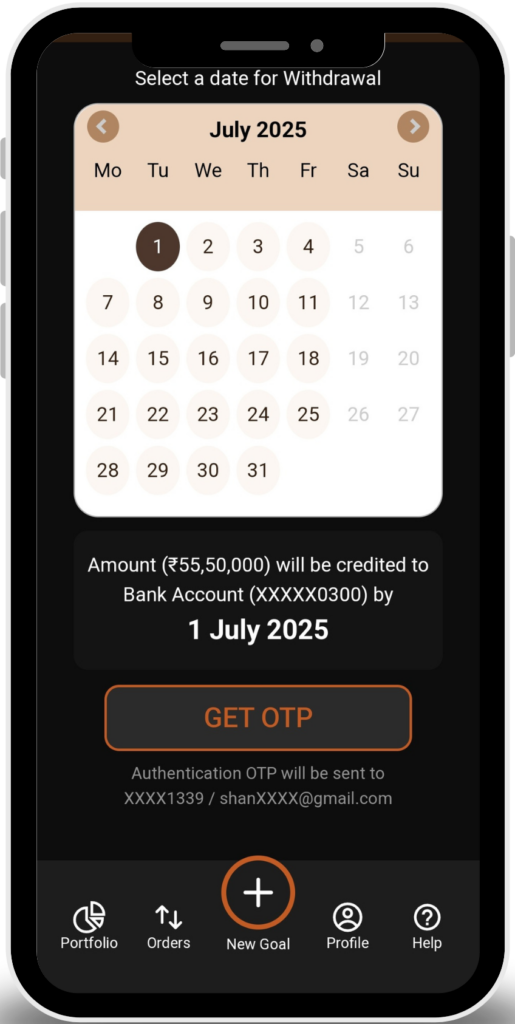

Withdraw Anytime

Redeem all or part of your funds anytime

Tailored for Businesses

Crafted for Founders, CFOs, and Finance teams

to bring peace of mind with seamless tech and simple, smart tools.

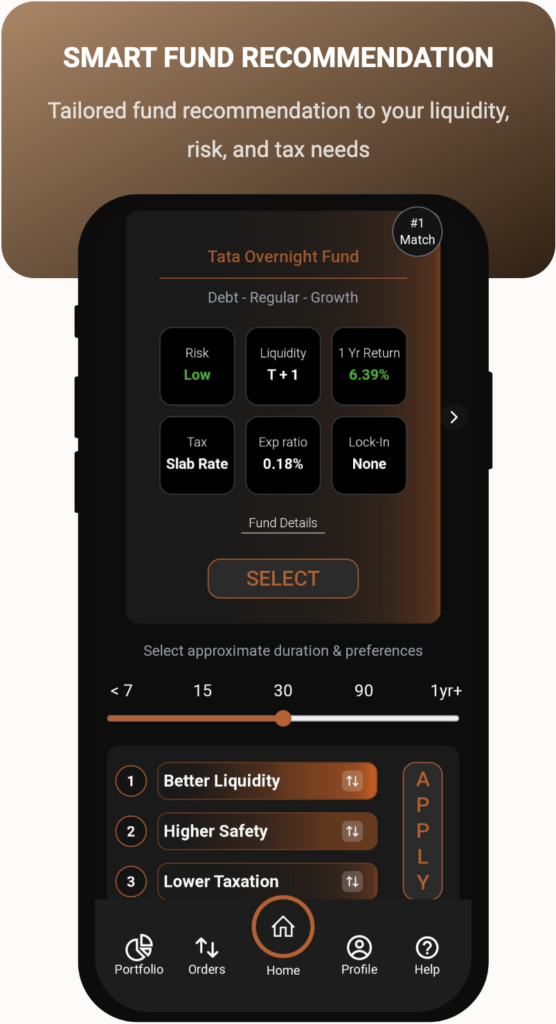

Smart Fund Recommendation

Tailored fund recommendation to your liquidity, risk, and tax needs

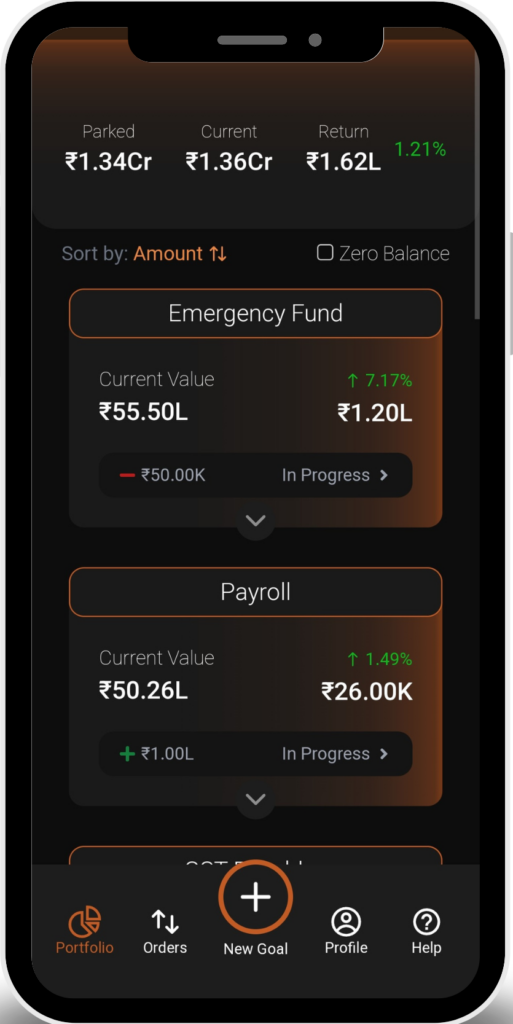

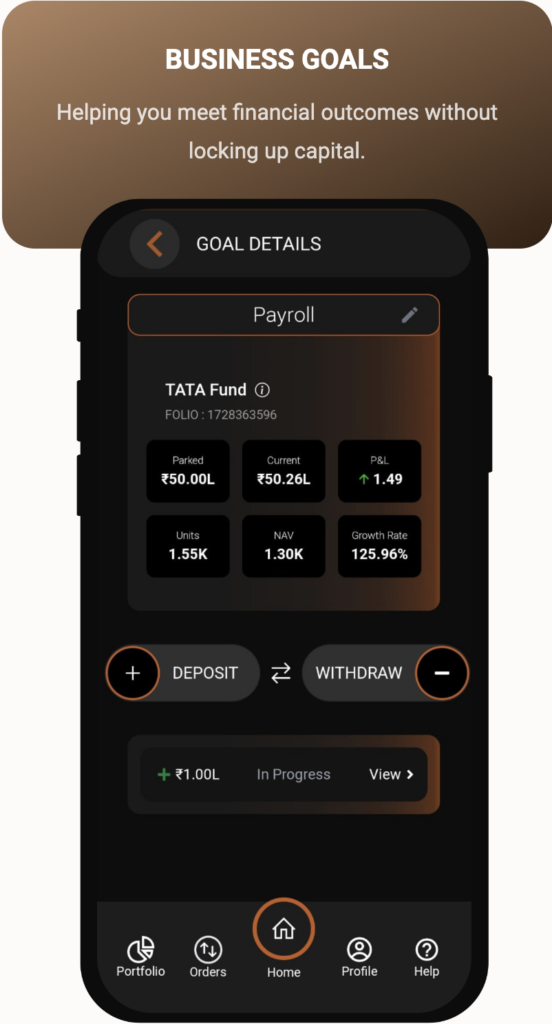

Business Goals

Helping you meet financial outcomes without locking up capital.

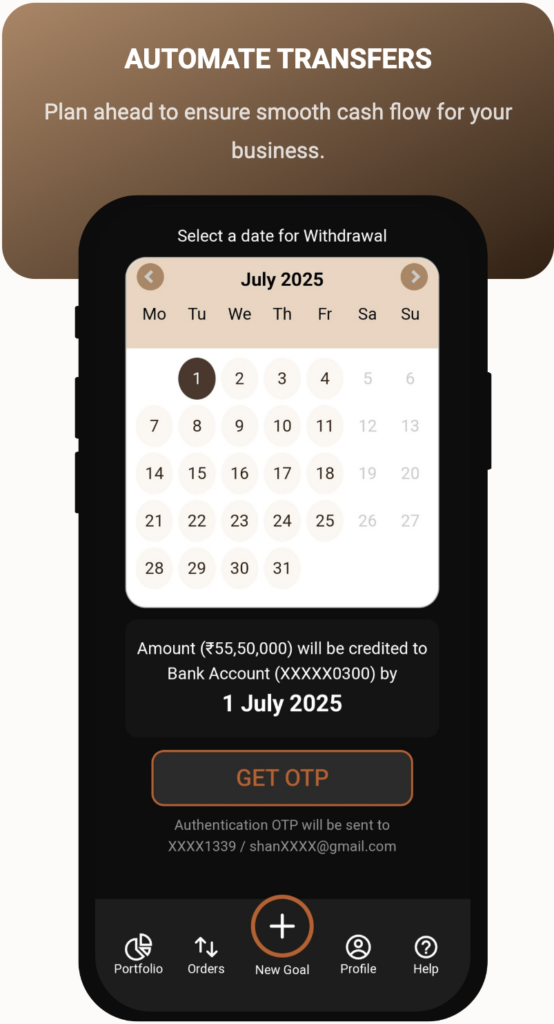

Automate Transfers

Plan ahead to ensure smooth cash flow for your business.

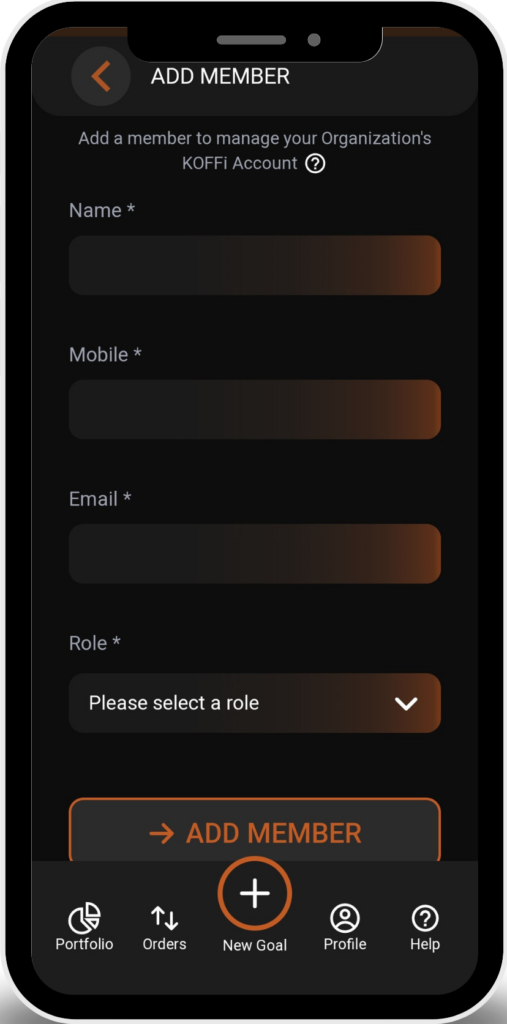

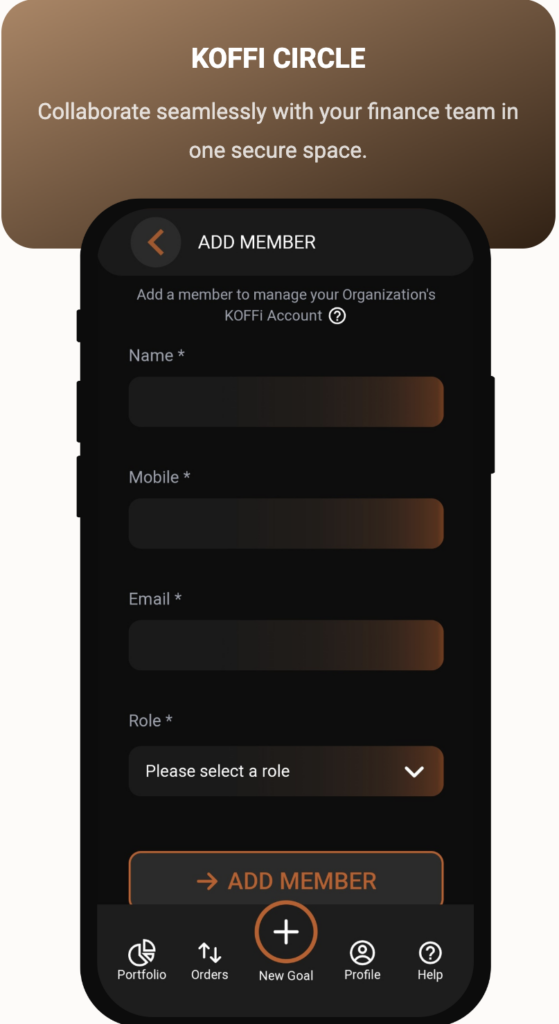

KOFFi Circle

Collaborate seamlessly with your finance team in one secure space.

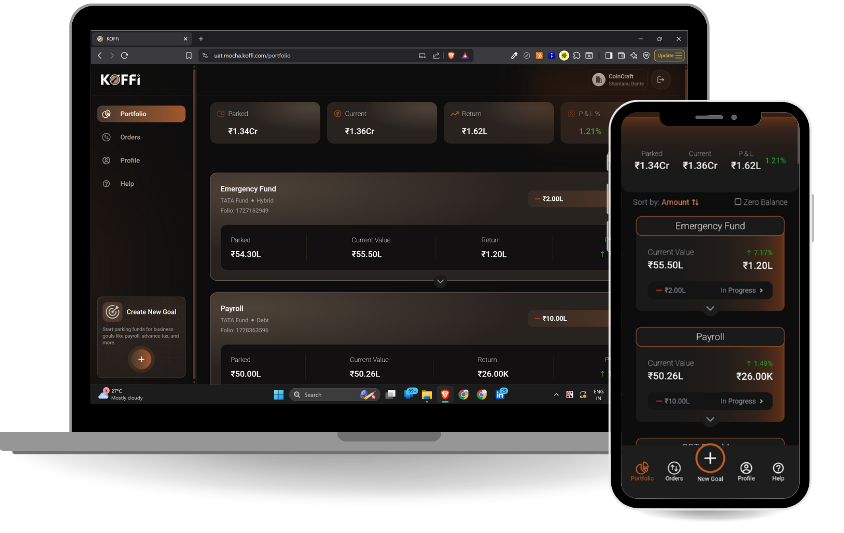

KOFFi is available anytime, anywhere - Mobile or Desktop

What Our Customer Says

YOUR MONEY NEVER RESIDES WITH US. We aim to provide you with the technology platform to connect with the safest rated financial products where your money will be held by the trusted fund houses like TATA & Aditya Birla. The financial products that are offered by KOFFi have been traditionally used by large corporations to keep their short-term funds.

Similar to fixed deposits, curated options provided by the KOFFi are linked with RBI interest rates, but with the added benefit of earning on your daily balances. This makes our fund selection perform much better in short-term as compared to FDs. Additionally, tax friendly and zero penalty options help you maximise yield for your money.

Currently, we provide a selection of carefully curated fixed-income securities, rated as the safest by SEBI, that invest exclusively in high-quality government and corporate fixed-income securities.

We are in the process of making additional fund options, deemed suitable for business fund parking, available to you in the coming months. The details of these funds and their timelines are listed on our website.

A debt fund is a mutual fund scheme that invests in diversified AAA rated financial instruments, such as government and corporate bonds, securities that offer steady capital appreciation.

A few major advantages of investing in debt funds are high liquidity, safety, low cost structure and better returns in the short term.

KOFFi are taxed at 20%, as opposed to 30% on traditional instruments like fixed deposits & savings accounts.

In KOFFi, your returns are only taxed when they are realised. Whereas in FD, tax is applicable every year irrespective of the realisation.

KOFFi is a business fund parking platform where, along with financial products, we plan to offer various tools to organise funds and manage cash-flow.

While we began with mutual funds due to their suitability for our primary use case, our long-term vision encompasses a broader range of secure financial products including T-Bills, Commercial papers, and more.

It’s a volume game for us, as the commission we earn from our trusted partners is miniscule. Behind the scenes, we work relentlessly to provide you the platform and choices that ensure your funds are safe, growing, and available whenever you need them.

While the scheduling of a withdrawal sounds simple, there are various attributes like cut-off time, bank settlement time, holidays, etc which makes it complex. Just give us a date and KOFFi will take care of all these complexities to ensure your money is available in your bank account on that date.

Absolutely, that’s what makes KOFFi stand out from the rest of the platforms. We are specifically designed for businesses, and we understand the need for support in running them. The KOFFi Circle feature allows you to add teammates with specific permissions to handle routine tasks. Please check the product tutorial here.

The KOFFi Goal feature allows you to categorize your funds based on business needs, making it easier to allocate and track funds for financial liabilities. You can create new goals (e.g., Payroll or GST Payables) and choose from our recommended fund options. Goals can be renamed to fit your evolving business needs, The enhanced portfolio overview displays funds organized by goals, offering a clearer view of your business financials.

Ask us Anything!

Ask us Anything!